The Outlook for Variable Rates

On the other hand, variable rates are expected to trend downward. The BoC is scheduled to make its next interest rate announcement on December 11, 2024, where analysts predict a potential rate cut in response to economic differences between Canada and the U.S. This anticipated adjustment could make variable-rate mortgages a more attractive option for prospective buyers.

Stability Expected for 2025

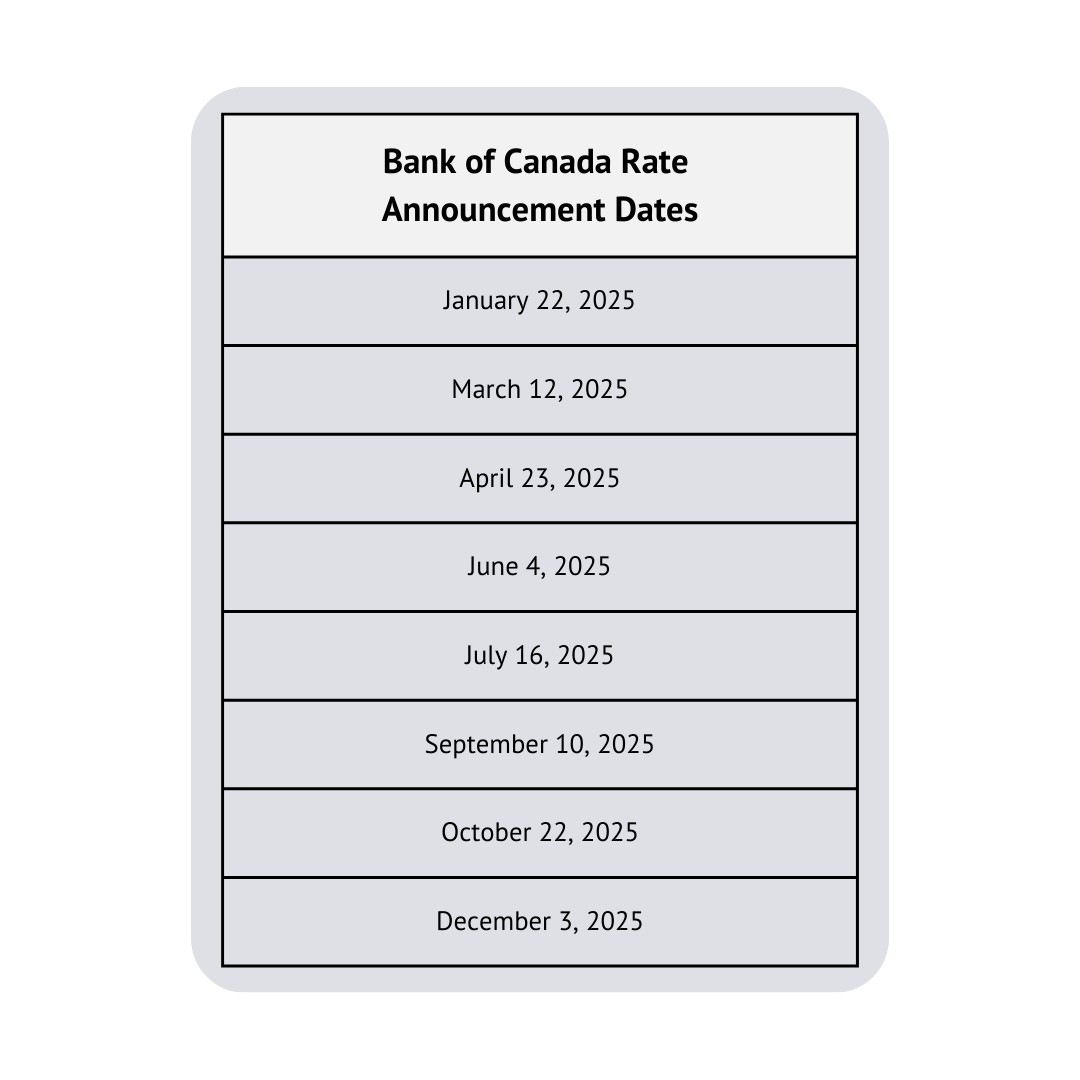

After recent fluctuations, mortgage rates in Canada may stabilize in 2025, with the Prime rate projected to hold at 5.20% throughout the year. For clarity, here’s a schedule of the BoC’s 2025 announcements:

What Homeowners and Buyers in Kamloops Should Expect

If you’re weighing fixed versus variable rates, it’s essential to consider these dynamics. Fixed rates may remain high due to external economic influences, while variable rates could offer a lower-cost option in the short term, pending the anticipated rate cut in December.

Staying Updated

For those considering a mortgage or renewal, the BoC’s December announcement is essential. According to an article from Financial Post, the BoC is expected to reduce rates by half a percentage point, which could provide relief for variable-rate mortgage holders in Kamloops.